south dakota property tax abatement

1 COUNTY AUDITOR OFFICE Print Document. The City of Sioux Falls has three different property tax abatement programs.

Thank you - South Dakota Property Tax Division.

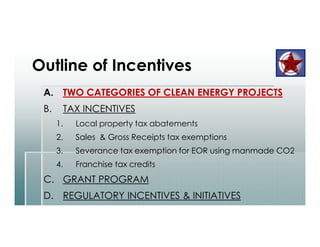

. Wind solar biomass hydrogen hydroelectric and geothermal systems used to produce electricity or energy are considered renewable resource systems. Pay Property Taxes Online. This form requires county information for the property you own.

The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax. A website link to the application for each program is available on the Planning Division website. SD State Treasurer 500 E Capitol Ave Ste 212 Pierre SD 57501.

PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers. Property tax continues to be among the most financially burdensome for low-income seniors and people with disabilities to absorb. SDCL 10-4-2410 states that dwellings or parts of multiple family dwellings which are specifically designed for use by paraplegics as wheelchair homes and which are owned and occupied by veterans with the loss or loss of use of both lower extremities or by the unremarried widow or widower of such veteran.

Tax Abatement Supporting Documentation 2. To protect your privacy this site uses a security certificate for secure and confidential communications. However five-year property tax abatements are available on new structures or additions to existing ones.

Income and property value limits apply. The tax base in Brown County is just over 4 billion. Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent.

South Dakota Department of Revenue. Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

Physical Address 104 N Main Street Suite 100 Canton SD 57013-1703. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. South Dakota then takes it one dramatic step farther.

If you do NOT know which county your property is located in please use the link below to identify the county name. 2 Year Tax Abatement - Properties with new construction may qualify for a two-year tax abatement. South Dakota property tax credit.

To 5 pm Monday - Friday. For the third week of the legislative session AARP South Dakota traveled to Pierre for our annual Lobby Day to let lawmakers know what issues are on the minds of South Dakotans over 50. Email the Treasurers Office.

South Dakota Property Tax Exemption. Property Tax Exemption for Veterans and their Widow or Widower. South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes.

10-18-11 Time allowed for abatement or refund of invalid inequitable or unjust tax. 1 The board may abate any or all of the delinquent taxes and penalty on real property if taxes remain unpaid and the property has been offered for sale as required by the code for two successive years and not sold because of depreciation in the value of the property or otherwise or if any property has been bid in by the county and one year has elapsed since the bid. General Inquiries Treasury Management.

Property Tax Relief - ExemptionsCredits. A proposal to alter the text of a pending bill or other measure by striking out some of it by inserting new language or both. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive.

To Apply Applications are available online or at any county treasurers office beginning in January of each year and must be submitted annually to your local county treasurers office on or before April 1st. Inquiries 605 773-3379 SD Toll Free 866 357-2547. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission.

Before an amendment becomes part of the measure thelegislature must agree to it. Having reviewed and examined an application for Abatement or Refund of Taxes in the amount of. Please check that you agree before.

Please notate ID wishing to pay. Eligible waterways are determined by the Department of Agriculture and Natural Resources with additional waterways as allowed by the county commission. The first 50000 or 70 of the assessed value of the property used for producing solar power ie your home whichever is greater is exempt from property taxes for four years.

Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709. Tax Breaks and Reductions State law provides several means to reduce the tax burden of senior citizens. Real Property Taxes.

Tax amount varies by county. Josh Haeder South Dakota State Treasurer. 2012 South Dakota Codified Laws Title 10 TAXATION Chapter 18.

CLICK HERE TO SEARCH YOUR COUNTY. Phone 605 773-3378 Fax 866 773-3115. Administering all state laws pertaining to the ad valorem property tax system Assisting with abatement Continuing to educate the public on the South Dakota tax system Determining tax exempt status for applicable properties Determining the taxable value of approximately 25000 parcels.

The forms are also available to download through the South Dakota State website. Search for a job. Sales and property tax refunds and property tax freezes are available to seniors who meet the qualifications.

For questions please call our customer service department at. That may well be the strongest property tax exemption weve seen in the country. What this abatement does is take 150000 off of the true full value of the home for figuring real estate property taxes for two years.

211 9th Street South Fargo ND 58103 701 297-6000. Apply Now Property Tax Reduction from Municipal Taxes for the Elderly Disabled. APPLICATION FOR ABATEMENT AND OR REFUND OF PROPERTY TAXES Tax Year Payable 2020 To the Board of County Commissioners for Hand County South Dakota Name.

For more information on whether or not your property qualifies please contact Dustin Powers at 605-367-8897 in the Planning Division. Welcome to a Property Tax Electronic Form. South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size.

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate outstanding on real property sold for taxes.

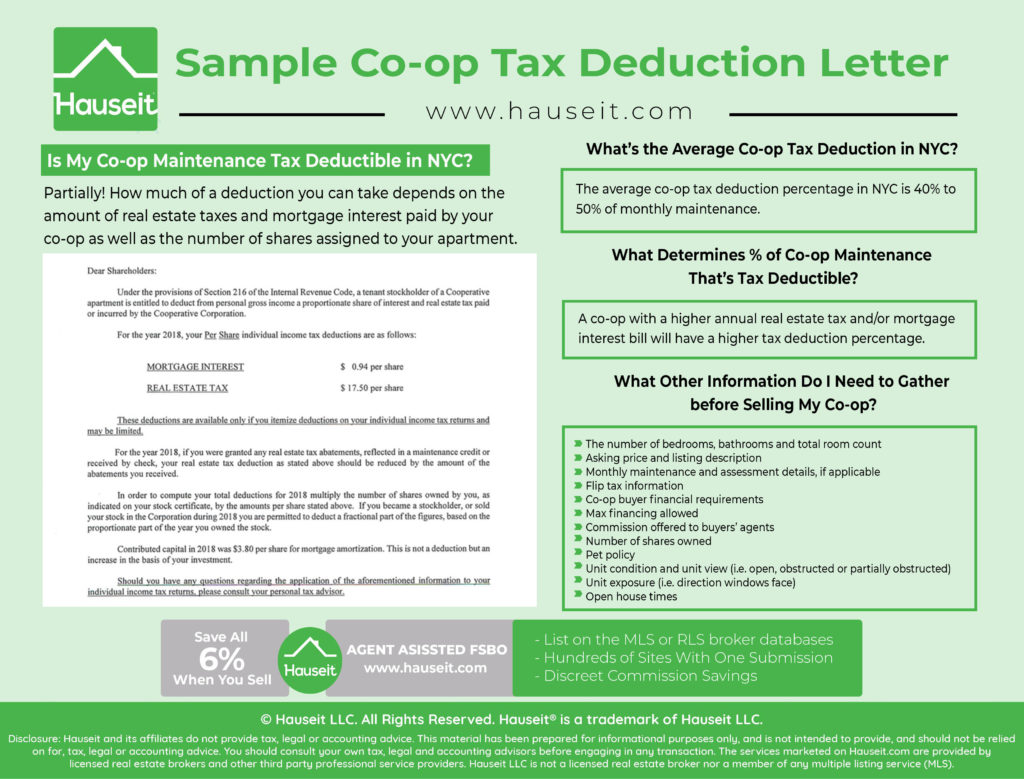

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

Luxury Ads에 있는 New World Group님의 핀 부동산 광고 포스터 레이아웃

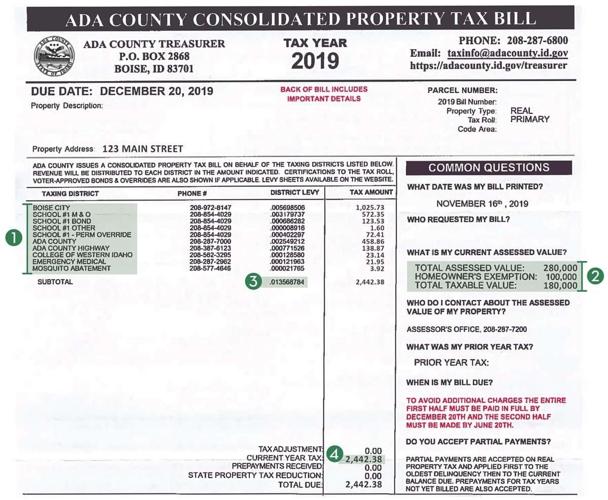

Inside Idaho S Complicated Property Tax System Money Idahopress Com

The City Of Columbus Offers 100 15 Year Property Tax Abatement Skyline House

Property Tax Comparison By State For Cross State Businesses

Webster Area Development Corporation Financing Incentives

Tax Abatement Nyc Guide 421a J 51 And More

Tax Abatement How Does It Help You Save On Property Taxes Mybanktracker

Tax Abatements In Context 2 Digging Deeper On Race And Inequality Good Jobs First

Property Tax Five Stone Tax Advisers

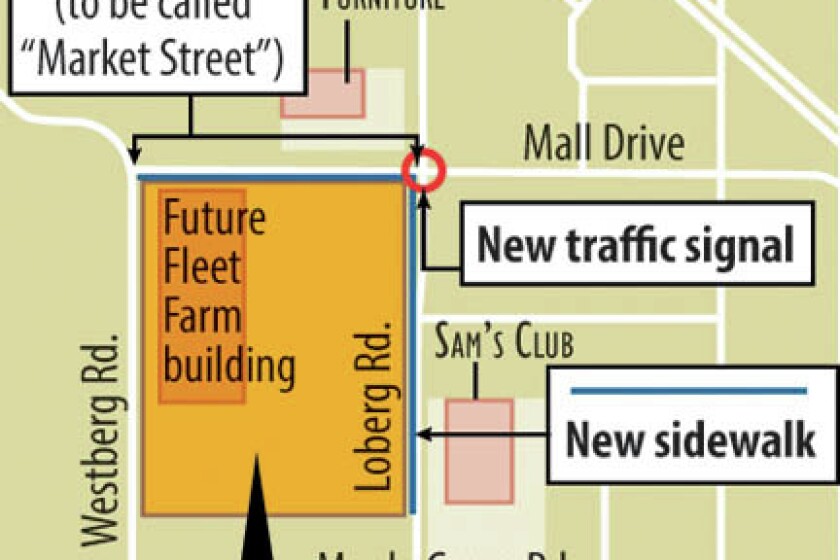

County Backs Tax Abatement For Hermantown Fleet Farm Project Duluth News Tribune News Weather And Sports From Duluth Minnesota

Get Real About Property Taxes 2nd Edition